Unveiling the Enigma: Why Insurance Doesn't Cover the COVID-19 Pandemic

The unprecedented outbreak of COVID-19 has sent shockwaves through the world, leaving an indelible mark on our lives. In the wake of this global crisis, many have turned to insurance policies expecting financial protection. However, to their dismay, most have discovered a sobering truth: insurance coverage for the COVID-19 pandemic is largely nonexistent. This article delves into the intricacies of insurance contracts, legal frameworks, and the underlying reasons why insurance companies are reluctant to extend coverage for this extraordinary event.

5 out of 5

| Language | : | English |

| File size | : | 5226 KB |

| Screen Reader | : | Supported |

| Print length | : | 236 pages |

| Lending | : | Enabled |

The Role of Insurance Contracts

At its core, insurance is a risk mitigation tool. Insurance companies analyze risks and determine the likelihood of an event occurring. Based on this assessment, they set premiums and offer policies that provide financial compensation if a covered event happens. However, insurance contracts are not all-encompassing; they specify the specific events and perils that are covered.

Exclusion of Pandemics

In the case of the COVID-19 pandemic, most insurance policies explicitly exclude coverage for pandemics, epidemics, and infectious diseases. This exclusion stems from several factors:

- Unpredictability: Pandemics are rare and unpredictable events, making it difficult for insurance companies to assess the risk and set adequate premiums.

- Global Impact: Pandemics can affect vast geographical areas, resulting in widespread financial losses that could overwhelm the capacity of insurance pools.

- Government Intervention: Governments often intervene during pandemics to implement containment measures, which can disrupt businesses and lead to financial losses. However, these losses may not be covered by insurance policies due to exclusions for government actions.

Exceptions to the Rule

While most insurance policies exclude coverage for pandemics, there are a few exceptions:

- Business Interruption Insurance: Some policies may offer limited coverage for business interruptions caused by government-Free Downloaded closures. However, the extent of coverage varies widely, and it is crucial to carefully review the policy language.

- Event Cancellation Insurance: This type of insurance may cover financial losses incurred due to the cancellation of events, including conferences, concerts, and sporting events. However, coverage typically requires that the cancellation be due to an unforeseen and uncontrollable event, such as a natural disaster.

Legal Challenges and Case Law

As the COVID-19 pandemic unfolded, several businesses filed lawsuits against their insurance companies seeking to recover losses. These lawsuits have yielded mixed results, with some courts ruling in favor of the insurers and others siding with the policyholders.

In one notable case, a group of restaurants in California argued that their business interruption insurance policies should cover their losses due to COVID-19-related closures. The court ruled in favor of the insurance companies, upholding the exclusion for pandemics and emphasizing the need for clear and unambiguous policy language.

The Future of Pandemic Coverage

The COVID-19 pandemic has exposed the limitations of insurance coverage for global crises. It is likely that insurance companies will reassess their policies and consider ways to address the evolving risk landscape.

One possible approach is to develop specialized pandemic insurance products that offer limited coverage for businesses in high-risk industries. However, this would likely come with higher premiums and more stringent underwriting criteria.

Another option is for governments to establish public-private partnerships to provide financial protection against pandemics. This would spread the risk across a broader pool and reduce the burden on individual insurance companies.

The lack of insurance coverage for the COVID-19 pandemic has highlighted the challenges of insuring against unforeseen and widespread risks. While there are some exceptions to the rule, most businesses and individuals are not protected from the financial consequences of a global pandemic. As we navigate the aftermath of this crisis, it is imperative to work towards enhancing insurance coverage for future pandemics and other catastrophic events. Through collaboration between the insurance industry, governments, and policyholders, we can strive to create a more resilient financial safety net for our communities.

Alt text for image: A group of people wearing face masks and social distancing to prevent the spread of COVID-19.

5 out of 5

| Language | : | English |

| File size | : | 5226 KB |

| Screen Reader | : | Supported |

| Print length | : | 236 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Beth Bartolini Salimbeni

Beth Bartolini Salimbeni John Richardson

John Richardson Ben Buckton

Ben Buckton Ted Orland

Ted Orland Bill Fivaz

Bill Fivaz David M Gitlitz

David M Gitlitz Gabriel Davis

Gabriel Davis Joshua Kurlantzick

Joshua Kurlantzick Bill Sherk

Bill Sherk Wendy Margolis

Wendy Margolis Sean Bartram

Sean Bartram Studs Terkel

Studs Terkel Ruth Everhart

Ruth Everhart Bernard T Fitzpatrick

Bernard T Fitzpatrick Bernard Cornwell

Bernard Cornwell Michelle Mcquaid

Michelle Mcquaid Joellen A Meglin

Joellen A Meglin Bill Miller

Bill Miller Gerry Donohue

Gerry Donohue R Bradley Snyder

R Bradley Snyder

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Vladimir NabokovThe Whole Art of Ventriloquism: Unlock the Secrets of Voice Throwing and...

Vladimir NabokovThe Whole Art of Ventriloquism: Unlock the Secrets of Voice Throwing and... Denzel HayesFollow ·4.9k

Denzel HayesFollow ·4.9k Fred FosterFollow ·17.7k

Fred FosterFollow ·17.7k Fredrick CoxFollow ·11.2k

Fredrick CoxFollow ·11.2k Kurt VonnegutFollow ·14k

Kurt VonnegutFollow ·14k Dan BellFollow ·4.8k

Dan BellFollow ·4.8k Ken FollettFollow ·3.7k

Ken FollettFollow ·3.7k Ricky BellFollow ·7.5k

Ricky BellFollow ·7.5k Deion SimmonsFollow ·16.1k

Deion SimmonsFollow ·16.1k

Ivan Cox

Ivan CoxSpeak With Ease: The Ultimate Guide to Public Speaking...

By Rupika Raj ...

Jesus Mitchell

Jesus MitchellVulcan Forge: A Suspense Thriller that Will Keep You on...

Vulcan Forge is...

Dashawn Hayes

Dashawn HayesThe Carteret Family Bob Martin: A Comprehensive Review

Bob Martin's...

Owen Simmons

Owen SimmonsUnlock the World of Cultural Nuances with "The Global...

Embark on a Journey of...

Ian McEwan

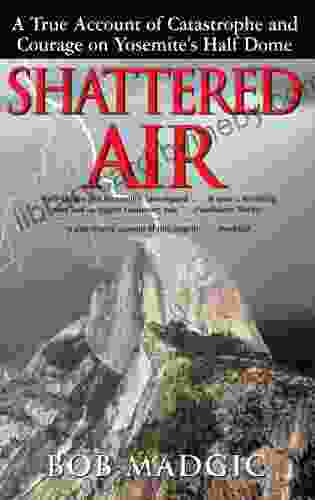

Ian McEwanConquer the Mountain: True Account of Catastrophe and...

In the heart of California's stunning...

5 out of 5

| Language | : | English |

| File size | : | 5226 KB |

| Screen Reader | : | Supported |

| Print length | : | 236 pages |

| Lending | : | Enabled |