The Speculation Economy: How Finance Triumphed Over Industry

In his new book, The Speculation Economy, George Soros argues that the global financial system has become a self-referential system that is no longer tied to the real economy. This has led to a dangerous bubble that is poised to burst.

Soros begins by outlining the history of the financial system, from its origins in the Italian city-states of the Renaissance to its current incarnation as a global network of interconnected markets. He shows how the financial system has evolved over time to become increasingly complex and opaque.

4.5 out of 5

| Language | : | English |

| File size | : | 1916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 680 pages |

| Lending | : | Enabled |

Soros argues that the deregulation of the financial system in the 1980s and 1990s has led to a dangerous increase in speculation. This speculation has been fueled by the rise of new financial instruments, such as derivatives, which have allowed investors to bet on the future value of assets without actually owning them.

Soros warns that the speculation bubble is unsustainable and that it is likely to burst in the near future. This would have devastating consequences for the global economy. Soros calls for a new regulatory framework for the financial system that would reduce speculation and protect the real economy.

The Speculation Economy is a timely and important book. It offers a clear and concise analysis of the current financial crisis and provides a roadmap for how we can avoid future crises. Soros is one of the world's leading financial experts, and his insights are essential reading for anyone who wants to understand the global economy.

Table of Contents

- Chapter 1: The Rise of the Financial System

- Chapter 2: The Deregulation of the Financial System

- Chapter 3: The Rise of Speculation

- Chapter 4: The Bubble Bursts

- Chapter 5: A New Regulatory Framework for the Financial System

Chapter 1: The Rise of the Financial System

The financial system has its origins in the Italian city-states of the Renaissance. These city-states were the first to develop a system of banking and credit that allowed merchants to finance their trade. The financial system gradually spread to other parts of Europe and eventually to the rest of the world.

The financial system has evolved over time to become increasingly complex and opaque. In the early days, the financial system was primarily used to facilitate trade. However, over time, the financial system has become increasingly used for speculation.

Chapter 2: The Deregulation of the Financial System

The deregulation of the financial system in the 1980s and 1990s led to a dangerous increase in speculation. This deregulation was motivated by the belief that the financial system was self-regulating and that it did not need government oversight.

The deregulation of the financial system has had a number of negative consequences. First, it has led to a significant increase in the level of debt in the global economy. Second, it has created a system that is more vulnerable to financial crises.

Chapter 3: The Rise of Speculation

The rise of speculation in the global financial system is one of the most important developments of the past few decades. Speculation is the practice of buying and selling assets in the hope of making a profit. Speculation can be a useful way to allocate capital, but it can also lead to financial bubbles and crises.

The rise of speculation has been fueled by a number of factors, including the deregulation of the financial system, the development of new financial instruments, and the rise of global capital flows.

Chapter 4: The Bubble Bursts

Soros argues that the speculation bubble is unsustainable and that it is likely to burst in the near future. This would have devastating consequences for the global economy.

Soros identifies a number of factors that could trigger the bursting of the bubble, including a rise in interest rates, a decline in the stock market, or a major geopolitical event.

Chapter 5: A New Regulatory Framework for the Financial System

Soros calls for a new regulatory framework for the financial system that would reduce speculation and protect the real economy.

Soros proposes a number of specific reforms, including:

- Raising capital requirements for banks

- Limiting the use of derivatives

- Creating a new international regulatory body

Soros argues that these reforms are necessary to prevent future financial crises.

The Speculation Economy is a timely and important book. It offers a clear and concise analysis of the current financial crisis and provides a roadmap for how we can avoid future crises. Soros is one of the world's leading financial experts, and his insights are essential reading for anyone who wants to understand the global economy.

4.5 out of 5

| Language | : | English |

| File size | : | 1916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 680 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Ines Balcik

Ines Balcik Bex Hogan

Bex Hogan James H Cone

James H Cone Ben Stroup

Ben Stroup Betsy Herman

Betsy Herman Bill Ingersoll

Bill Ingersoll Paula Polk Lillard

Paula Polk Lillard Jeff Astor

Jeff Astor Jaleen Grove

Jaleen Grove Ted Dorsey

Ted Dorsey Brian Borgford

Brian Borgford Damo Mitchell

Damo Mitchell Bill Rumpel

Bill Rumpel Pat Shipman

Pat Shipman Bill Franks

Bill Franks Berkeley Breathed

Berkeley Breathed Rosecrans Baldwin

Rosecrans Baldwin Howard Marks

Howard Marks Bill Plympton

Bill Plympton Jewell Parker Rhodes

Jewell Parker Rhodes

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Yukio MishimaUnveiling the Enchanting World of "The Search For Amara Teen": A Journey of...

Yukio MishimaUnveiling the Enchanting World of "The Search For Amara Teen": A Journey of...

Justin BellUnveiling the Comprehensive Guide for Parents Navigating Clubfoot: A Journey...

Justin BellUnveiling the Comprehensive Guide for Parents Navigating Clubfoot: A Journey...

Gavin MitchellTwisted Tales Not To Be Read At Night: Chilling Stories for a Spine-Tingling...

Gavin MitchellTwisted Tales Not To Be Read At Night: Chilling Stories for a Spine-Tingling... Eli BrooksFollow ·9k

Eli BrooksFollow ·9k Devin CoxFollow ·4.7k

Devin CoxFollow ·4.7k Fred FosterFollow ·17.7k

Fred FosterFollow ·17.7k Harrison BlairFollow ·12.3k

Harrison BlairFollow ·12.3k Guillermo BlairFollow ·9.7k

Guillermo BlairFollow ·9.7k Eric HayesFollow ·6.3k

Eric HayesFollow ·6.3k Kevin TurnerFollow ·8.1k

Kevin TurnerFollow ·8.1k Kazuo IshiguroFollow ·9.4k

Kazuo IshiguroFollow ·9.4k

Ivan Cox

Ivan CoxSpeak With Ease: The Ultimate Guide to Public Speaking...

By Rupika Raj ...

Jesus Mitchell

Jesus MitchellVulcan Forge: A Suspense Thriller that Will Keep You on...

Vulcan Forge is...

Dashawn Hayes

Dashawn HayesThe Carteret Family Bob Martin: A Comprehensive Review

Bob Martin's...

Owen Simmons

Owen SimmonsUnlock the World of Cultural Nuances with "The Global...

Embark on a Journey of...

Ian McEwan

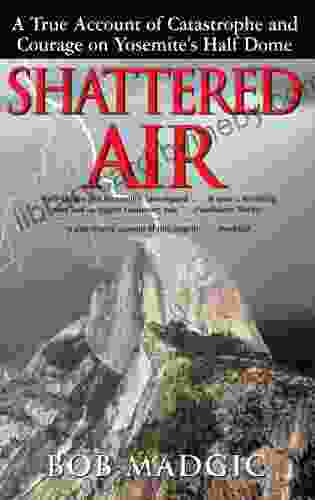

Ian McEwanConquer the Mountain: True Account of Catastrophe and...

In the heart of California's stunning...

4.5 out of 5

| Language | : | English |

| File size | : | 1916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 680 pages |

| Lending | : | Enabled |