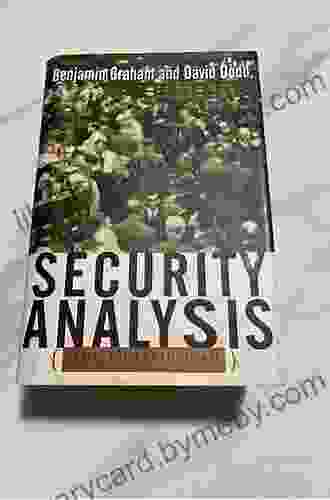

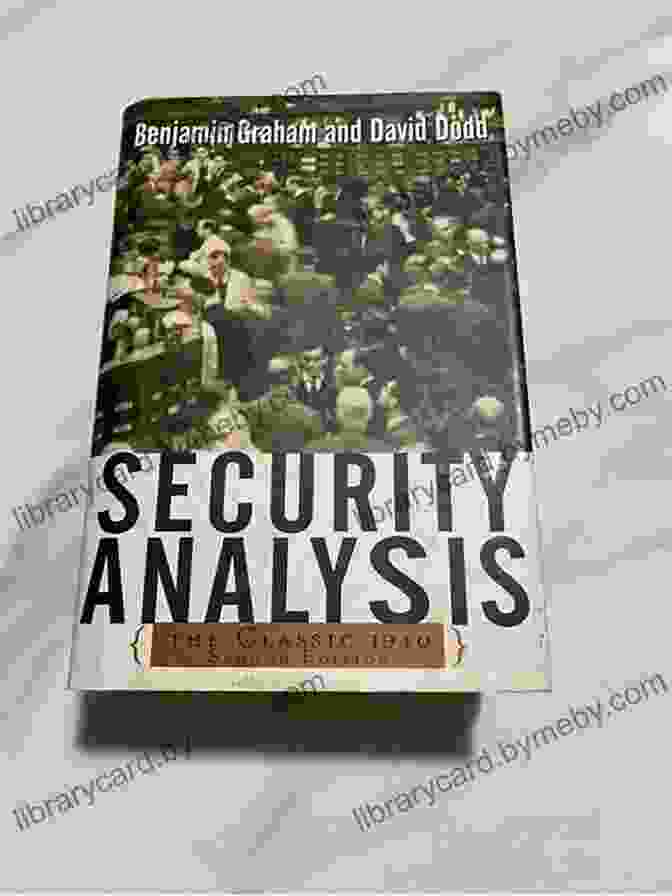

Master the Art of Value Investing with Security Analysis: The Classic 1940 Edition

Table of Contents

- Fundamental Concepts

- Stock Analysis

- Bond Analysis

- Industry Analysis

- Economic Analysis

- Portfolio Management

- Special Situations

- Relevance Today

- Free Download Your Copy Today

In the realm of investing, Benjamin Graham's "Security Analysis" stands as a timeless masterpiece, an essential guidebook for anyone seeking to master the art of value investing. First published in 1934, this classic text has shaped generations of investors, offering penetrating insights and practical wisdom that remains profoundly relevant today.

The 1940 edition, meticulously revised and updated by Graham, represents the culmination of his half-century of experience in the financial markets. It provides a comprehensive roadmap for understanding the fundamental principles underlying successful investing, laying the groundwork for the value investing approach that has consistently outperformed the market over time.

4.8 out of 5

| Language | : | English |

| File size | : | 33867 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 868 pages |

Fundamental Concepts

Graham begins by establishing the foundation upon which all sound investment decisions rest. He emphasizes the importance of intrinsic value, the inherent worth of a company or asset, which he believes can be determined through rigorous financial analysis. Intrinsic value serves as the anchor for all investment decisions, guiding investors towards undervalued securities with the potential for substantial returns.

Graham introduces his "margin of safety" concept, a crucial principle that protects investors from unforeseen risks. By investing in securities trading at a significant discount to their intrinsic value, investors can mitigate the impact of market fluctuations and enhance their chances of long-term success.

Stock Analysis

The majority of "Security Analysis" focuses on the thorough examination of stocks, outlining a comprehensive methodology for assessing a company's financial health, industry position, and future prospects. Graham delves into the balance sheet, income statement, and cash flow statement, providing invaluable techniques for interpreting financial data and identifying hidden opportunities.

He emphasizes the importance of qualitative factors, such as management, business models, and industry dynamics, which can significantly influence a company's intrinsic value. Graham also introduces the concept of "net-nets," stocks trading below their net current asset value, providing investors with a potentially lucrative investment strategy.

Bond Analysis

While Graham's primary focus is on stocks, he also dedicates a substantial portion of "Security Analysis" to the analysis of bonds. He explains the different types of bonds, their risk and return characteristics, and the techniques for assessing their creditworthiness. Graham emphasizes the importance of diversification, recommending that investors allocate a portion of their portfolio to bonds to reduce overall risk.

Industry Analysis

Graham recognizes the profound impact that industry-specific factors can have on a company's success. He encourages investors to conduct thorough industry analysis, examining the competitive landscape, technological advancements, and regulatory environment. By understanding the industry dynamics, investors can gain an edge in identifying attractive investment opportunities.

Economic Analysis

Graham stresses the importance of considering the broader economic context when making investment decisions. He explains how economic cycles, interest rates, and inflation can influence the performance of individual companies and entire sectors. By understanding the economic landscape, investors can position their portfolios for long-term success.

Portfolio Management

In addition to providing guidance on individual security selection, "Security Analysis" also covers the principles of portfolio management. Graham discusses the importance of diversification, asset allocation, and risk management. He outlines strategies for constructing portfolios that align with investors' risk appetites and financial goals.

Special Situations

Graham concludes his exploration of investment analysis with a chapter on special situations, opportunities that arise from unique market circumstances. He examines merger arbitrage, bank failures, and other complex investment scenarios, providing investors with the tools to navigate these complex and potentially lucrative situations.

Relevance Today

While "Security Analysis" was written over eight decades ago, its principles remain profoundly relevant in today's rapidly evolving financial markets. Graham's focus on intrinsic value, margin of safety, and thorough analysis continues to guide successful investors worldwide.

In an era of high-frequency trading and complex financial instruments, Graham's time-tested wisdom serves as an antidote to market noise and short-term speculation. By embracing Graham's approach, investors can navigate the complexities of modern markets and position themselves for long-term wealth creation.

Free Download Your Copy Today

Invest in your financial future with "Security Analysis: The Classic 1940 Edition." This timeless masterpiece by Benjamin Graham will empower you with the knowledge and wisdom to master the art of value investing and achieve your financial goals.

Don't miss out on this opportunity to own a copy of one of the most influential investment books ever written. Free Download your copy of "Security Analysis: The Classic 1940 Edition" today and embark on your journey to financial success.

4.8 out of 5

| Language | : | English |

| File size | : | 33867 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 868 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Billie Coleman

Billie Coleman Kenji Ojima

Kenji Ojima Bob Gregory

Bob Gregory Jennifer Tyler Lee

Jennifer Tyler Lee Janey Lee Grace

Janey Lee Grace Ben Hodges

Ben Hodges Bill Dance

Bill Dance Bisco Hatori

Bisco Hatori Billy Connolly

Billy Connolly Michael Hathaway

Michael Hathaway Blackthorn Hart

Blackthorn Hart Bert Randolph Sugar

Bert Randolph Sugar Melanie Challenger

Melanie Challenger Keith Whiting

Keith Whiting Ilka Hammer

Ilka Hammer Blair Howard

Blair Howard Sharon Weinberger

Sharon Weinberger Daniela Sacerdoti

Daniela Sacerdoti Eddie Rice

Eddie Rice Ben Westhoff

Ben Westhoff

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Isaiah PowellFollow ·5.9k

Isaiah PowellFollow ·5.9k Charles BukowskiFollow ·19.2k

Charles BukowskiFollow ·19.2k Jayden CoxFollow ·9.8k

Jayden CoxFollow ·9.8k Elmer PowellFollow ·11.6k

Elmer PowellFollow ·11.6k Jordan BlairFollow ·3.9k

Jordan BlairFollow ·3.9k Hugh BellFollow ·8.5k

Hugh BellFollow ·8.5k Ivan TurgenevFollow ·3.5k

Ivan TurgenevFollow ·3.5k Eric NelsonFollow ·5.2k

Eric NelsonFollow ·5.2k

Ivan Cox

Ivan CoxSpeak With Ease: The Ultimate Guide to Public Speaking...

By Rupika Raj ...

Jesus Mitchell

Jesus MitchellVulcan Forge: A Suspense Thriller that Will Keep You on...

Vulcan Forge is...

Dashawn Hayes

Dashawn HayesThe Carteret Family Bob Martin: A Comprehensive Review

Bob Martin's...

Owen Simmons

Owen SimmonsUnlock the World of Cultural Nuances with "The Global...

Embark on a Journey of...

Ian McEwan

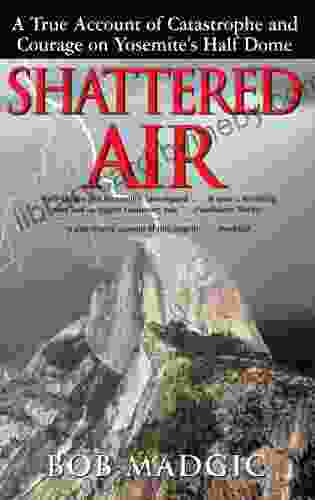

Ian McEwanConquer the Mountain: True Account of Catastrophe and...

In the heart of California's stunning...

4.8 out of 5

| Language | : | English |

| File size | : | 33867 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 868 pages |