Unlock Your Financial Freedom: The Ultimate Personal Finance System for Freelancers, Entrepreneurs, and Side Hustlers

As a freelancer, entrepreneur, or side hustler, managing your personal finances can be a daunting task. You're responsible for generating income, managing expenses, and planning for the future, all while juggling multiple projects and schedules.

This comprehensive article will introduce you to a proven personal finance system designed specifically for the unique challenges faced by freelancers, entrepreneurs, and side hustlers. By following the steps outlined in this guide, you'll gain the knowledge and tools necessary to take control of your finances, reach your financial goals, and secure your financial future.

4.8 out of 5

| Language | : | English |

| File size | : | 1920 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

The Importance of a Personal Finance System

Before we dive into the specifics of our system, it's crucial to understand why having a robust personal finance system is essential:

* Financial Control: A well-structured system gives you complete visibility into your income and expenses, empowering you to make informed financial decisions. * Tax Preparation: Properly organized financial records make tax filing a breeze, ensuring accuracy and avoiding costly mistakes. * Financial Security: A sound finance system provides a solid foundation for your financial well-being, enabling you to confidently plan for emergencies and pursue financial goals.

The Step-by-Step Personal Finance System

Our step-by-step personal finance system is designed to streamline your financial management, maximize your income, and minimize your expenses.

Step 1: Track Your Income and Expenses

The first step is to establish a comprehensive system for tracking your income and expenses. This can be done using a spreadsheet, accounting software, or budgeting apps. By diligently recording every transaction, you'll gain a clear picture of where your money is coming from and going.

Step 2: Create a Budget

Once you have a clear understanding of your income and expenses, you can create a budget. A budget is a plan that allocates your income to different categories, such as expenses, savings, and investments. Sticking to your budget will ensure that your money is being used wisely and that you're making progress towards your financial goals.

Step 3: Reduce Unnecessary Expenses

After creating a budget, you can identify areas where you can reduce unnecessary expenses. This could include negotiating lower interest rates on loans, canceling subscriptions you don't use, or finding more affordable alternatives to services. Every dollar you save can be reinvested into your business or towards your financial goals.

Step 4: Increase Your Income

In addition to reducing expenses, you can also focus on increasing your income. This could involve developing new products or services, expanding your offerings, or finding additional clients. By proactively seeking ways to generate more revenue, you can accelerate your financial progress.

Step 5: Save and Invest Wisely

Finally, it's crucial to develop a sound savings and investment strategy. This involves setting aside money for emergencies, as well as investing for the long term. By saving and investing wisely, you can build your wealth, secure your financial future, and achieve your financial dreams.

Additional Tips for Freelancers, Entrepreneurs, and Side Hustlers

In addition to the basic steps outlined above, here are some additional tips for successfully managing your personal finances as a freelancer, entrepreneur, or side hustler:

* Estimate Your Project Income Accurately: Freelancers and entrepreneurs often work on projects that span multiple months or even years. To ensure accurate financial planning, carefully estimate the income you expect to receive from each project. * Set Aside Taxes: As a self-employed individual, you're responsible for paying your own taxes. Make sure to set aside a portion of your income to cover estimated tax payments, to avoid any surprises come tax season. * Protect Your Assets: Consider obtaining insurance to protect your business equipment, intellectual property, and personal assets. This will provide you with peace of mind and safeguard your financial future in the event of an unexpected incident. * Seek Professional Advice: If you need additional guidance or have complex financial needs, don't hesitate to seek professional help from a financial advisor or tax accountant. A qualified professional can provide personalized advice and help you navigate the intricacies of personal finance.

Managing your personal finances as a freelancer, entrepreneur, or side hustler can be challenging, but by following the steps outlined in this guide, you can gain control of your money, achieve your financial goals, and secure your financial future. Remember, financial freedom is not a destination but a journey. By implementing the principles of this personal finance system and continuously seeking ways to improve, you can take control of your finances and unlock your full financial potential.

4.8 out of 5

| Language | : | English |

| File size | : | 1920 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Omari Mcqueen

Omari Mcqueen Bev Sellars

Bev Sellars Bill Duke

Bill Duke Justin Doyle

Justin Doyle Billy Hansen

Billy Hansen Kyle Mitchell

Kyle Mitchell Beverly Biderman

Beverly Biderman Christopher Cousteau

Christopher Cousteau Blake Sebring

Blake Sebring Beth Ferry

Beth Ferry Gabriel Davis

Gabriel Davis Betty G Birney

Betty G Birney Doug Wead

Doug Wead Dave Stangis

Dave Stangis Sara Wolf

Sara Wolf Ellen Ward Lopez

Ellen Ward Lopez David Tuffley

David Tuffley Bill Clegg

Bill Clegg David Rock

David Rock Bill Bellamy

Bill Bellamy

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Lucas ReedFollow ·2.9k

Lucas ReedFollow ·2.9k Devin RossFollow ·12.5k

Devin RossFollow ·12.5k Jonathan FranzenFollow ·3.6k

Jonathan FranzenFollow ·3.6k Duane KellyFollow ·19.6k

Duane KellyFollow ·19.6k John UpdikeFollow ·2.2k

John UpdikeFollow ·2.2k Fernando PessoaFollow ·13.9k

Fernando PessoaFollow ·13.9k Carter HayesFollow ·9.6k

Carter HayesFollow ·9.6k Justin BellFollow ·16.7k

Justin BellFollow ·16.7k

Ivan Cox

Ivan CoxSpeak With Ease: The Ultimate Guide to Public Speaking...

By Rupika Raj ...

Jesus Mitchell

Jesus MitchellVulcan Forge: A Suspense Thriller that Will Keep You on...

Vulcan Forge is...

Dashawn Hayes

Dashawn HayesThe Carteret Family Bob Martin: A Comprehensive Review

Bob Martin's...

Owen Simmons

Owen SimmonsUnlock the World of Cultural Nuances with "The Global...

Embark on a Journey of...

Ian McEwan

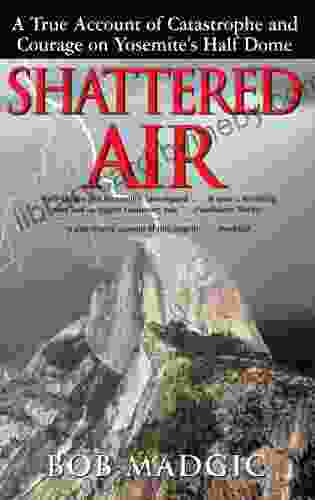

Ian McEwanConquer the Mountain: True Account of Catastrophe and...

In the heart of California's stunning...

4.8 out of 5

| Language | : | English |

| File size | : | 1920 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |