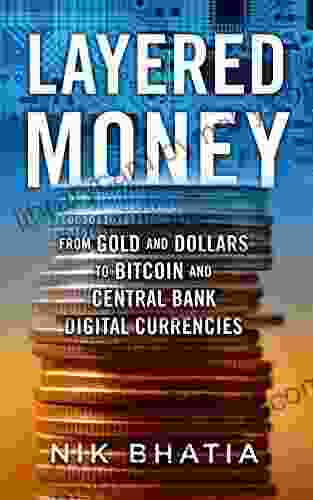

From Gold and Dollars to Bitcoin and Central Bank Digital Currencies: The Future of Money

Money is a fundamental part of our lives. We use it to buy food, pay our bills, and save for the future. But what is money, exactly? And how has it evolved over time?

4.7 out of 5

| Language | : | English |

| File size | : | 3291 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 180 pages |

The history of money is long and complex, but it can be divided into three main eras:

- The commodity era: In the early days, money was a physical commodity, such as gold or silver. These commodities had value in themselves, and they were used as money because they were scarce, durable, and easily divisible.

- The fiat era: In the 19th century, governments began to issue paper money that was not backed by any physical commodity. This fiat money was valuable only because the government said it was.

- The digital era: In the 21st century, we have seen the rise of digital currencies, such as Bitcoin and central bank digital currencies. These currencies are not physical, and they are not backed by any government. Instead, they rely on cryptography to secure transactions and control the supply of money.

The future of money is uncertain. However, it is clear that we are entering a new era in which digital currencies will play an increasingly important role. In this book, we will explore the evolution of money from its origins in gold and silver to the advent of Bitcoin and central bank digital currencies. We will also discuss the potential implications of these new technologies for the future of money and the global economy.

The Commodity Era

The commodity era of money began in ancient times, when people used physical commodities, such as gold and silver, to trade for goods and services. These commodities had value in themselves, and they were used as money because they were scarce, durable, and easily divisible.

Gold and silver were particularly well-suited for use as money because they are relatively rare, they do not corrode easily, and they can be easily divided into smaller units. In addition, gold and silver have a long history of being used as money, which gave them a degree of trust and acceptance.

The commodity era of money lasted for centuries. However, it began to come to an end in the 19th century, when governments began to issue paper money that was not backed by any physical commodity. This fiat money was valuable only because the government said it was.

The Fiat Era

The fiat era of money began in the 19th century, when governments began to issue paper money that was not backed by any physical commodity. This fiat money was valuable only because the government said it was.

Fiat money was initially used to finance wars and other government spending. However, it soon became the dominant form of money in most countries. This was due in part to the convenience of fiat money. It was much easier to carry around and use than gold or silver.

Fiat money also gave governments more control over the economy. By controlling the supply of money, governments could influence interest rates and inflation. This gave them a powerful tool for managing the economy.

However, fiat money also has some drawbacks. One of the biggest drawbacks is that it is subject to inflation. Inflation is the increase in the general price level of goods and services. When inflation occurs, the value of fiat money decreases. This can make it difficult for people to save for the future and plan for retirement.

The Digital Era

The digital era of money began in the 21st century, with the advent of Bitcoin and other cryptocurrencies. Cryptocurrencies are digital currencies that are secured by cryptography. This means that they are very difficult to counterfeit or hack.

Cryptocurrencies are not backed by any government or central bank. Instead, they rely on a decentralized network of computers to verify transactions and control the supply of money.

Cryptocurrencies have a number of advantages over fiat money. They are more secure, they are more portable, and they are not subject to inflation. However, cryptocurrencies also have some drawbacks. They are more volatile than fiat money, they can be difficult to use, and they are not as widely accepted.

Central bank digital currencies (CBDCs) are a new type of digital currency that is issued by a central bank. CBDCs are similar to cryptocurrencies, but they are backed by the full faith and credit of the government. This makes them more stable and reliable than cryptocurrencies.

CBDCs have a number of potential benefits. They could make payments more efficient and secure. They could also help to promote financial inclusion by making it easier for people to access banking services.

However, CBDCs also have some potential drawbacks. They could give governments too much control over the economy. They could also be used to track and monitor people's financial transactions.

The Future of Money

The future of money is uncertain. However, it is clear that we are entering a new era in which digital currencies will play an increasingly important role.

Cryptocurrencies and CBDCs have the potential to revolutionize the way we think about money. They could make payments more efficient and secure, they could help to promote financial inclusion, and they could give us more control over our money.

However, there are also some challenges that need to be addressed. Cryptocurrencies are volatile and difficult to use, and CBDCs could give governments too much control over the economy. It is important to weigh the potential benefits and drawbacks of these new technologies before we decide how to use them.

One thing is for sure: the future of money will be different from the past. We are entering a new era, and we need to be prepared for the changes that lie ahead.

4.7 out of 5

| Language | : | English |

| File size | : | 3291 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 180 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Ben Rothenberg

Ben Rothenberg Thomas Dublin

Thomas Dublin Bill Parisi

Bill Parisi Steven C Hayes

Steven C Hayes Tyler Gordon

Tyler Gordon Jean Paul Sartre

Jean Paul Sartre Ben Stoeger

Ben Stoeger Benjamin Gomes Casseres

Benjamin Gomes Casseres Harlow Robinson

Harlow Robinson Hank Olguin

Hank Olguin Karen Fisman

Karen Fisman Joe Foster

Joe Foster Bernadette Simpson

Bernadette Simpson Beth Reiber

Beth Reiber Ricki Linksman

Ricki Linksman Stuart Stevens

Stuart Stevens Phoebe Bailey

Phoebe Bailey Bernard Lee Deleo

Bernard Lee Deleo Ben Rhodes

Ben Rhodes Betty Jo

Betty Jo

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Orson Scott CardUnveiling the Extraordinary: A Journey into T.J. Klune's Captivating Novel

Orson Scott CardUnveiling the Extraordinary: A Journey into T.J. Klune's Captivating Novel

John SteinbeckUnlock Your Potential: The Ultimate Guide for Athletes - Little Black For...

John SteinbeckUnlock Your Potential: The Ultimate Guide for Athletes - Little Black For... Milan KunderaFollow ·8.7k

Milan KunderaFollow ·8.7k Steven HayesFollow ·7.1k

Steven HayesFollow ·7.1k Jackson HayesFollow ·5.8k

Jackson HayesFollow ·5.8k Owen SimmonsFollow ·8.3k

Owen SimmonsFollow ·8.3k Jedidiah HayesFollow ·2.5k

Jedidiah HayesFollow ·2.5k Bryson HayesFollow ·19.3k

Bryson HayesFollow ·19.3k Luke BlairFollow ·11.1k

Luke BlairFollow ·11.1k Cameron ReedFollow ·11.9k

Cameron ReedFollow ·11.9k

Ivan Cox

Ivan CoxSpeak With Ease: The Ultimate Guide to Public Speaking...

By Rupika Raj ...

Jesus Mitchell

Jesus MitchellVulcan Forge: A Suspense Thriller that Will Keep You on...

Vulcan Forge is...

Dashawn Hayes

Dashawn HayesThe Carteret Family Bob Martin: A Comprehensive Review

Bob Martin's...

Owen Simmons

Owen SimmonsUnlock the World of Cultural Nuances with "The Global...

Embark on a Journey of...

Ian McEwan

Ian McEwanConquer the Mountain: True Account of Catastrophe and...

In the heart of California's stunning...

4.7 out of 5

| Language | : | English |

| File size | : | 3291 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 180 pages |