Unlocking Tax Savings and Maximizing Business Potential: A Comprehensive Guide to Filing Corporation Election

In the competitive landscape of business, strategic decision-making is crucial for success and growth. One such decision that can significantly impact your business's financial trajectory is the filing of Corporation Election. Understanding the nuances of Corporation Election, its implications, and the process involved is essential for business owners seeking to optimize their operations and unlock tax savings. This comprehensive guide will delve into the intricacies of Corporation Election, providing you with a clear understanding of the options available, the associated benefits and drawbacks, and the step-by-step process of filing. By leveraging the insights and guidance provided in this guide, you can make informed decisions that will empower your business to thrive.

4.7 out of 5

| Language | : | English |

| File size | : | 13832 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 241 pages |

| Lending | : | Enabled |

Understanding Corporation Election

Corporation Election, also known as S Corporation Election, is a strategic decision that allows eligible businesses to choose how they are taxed by the Internal Revenue Service (IRS). By default, corporations are taxed as C Corporations, which means their profits are taxed at the corporate level and then again when distributed to shareholders as dividends. However, businesses can opt to be taxed as S Corporations, which allows them to pass corporate income, losses, deductions, and credits directly to their shareholders, who then report these items on their individual tax returns. This can result in significant tax savings, especially for small businesses with low profits and high shareholder involvement.

Benefits of Filing Corporation Election

- Potential Tax Savings: S Corporations can avoid double taxation by passing income and losses through to shareholders, who are taxed at their individual rates, which can be lower than the corporate tax rate.

- Increased Flexibility: S Corporations have more flexibility in distributing profits and losses to shareholders, allowing for customized and efficient tax planning.

- Simplified Tax Filing: S Corporations file a single tax return (Form 1120-S) instead of multiple returns, reducing the administrative burden and potential for errors.

- Enhanced Retirement Benefits: S Corporation shareholders can contribute to retirement plans, such as SEP IRAs and SIMPLE IRAs, which provide additional tax benefits.

Drawbacks of Filing Corporation Election

- Shareholder Eligibility: To qualify as an S Corporation, there are restrictions on the number and type of shareholders. Ownership must be limited to individuals, estates, and certain trusts.

- Passive Income Limitations: S Corporations are limited in the amount of passive income they can generate. Excessive passive income can result in the corporation losing its S Corporation status.

- Potential Loss of Employee Benefits: Shareholders of S Corporations are considered self-employed and may not be eligible for certain employee benefits, such as health insurance and paid time off.

- Potential Tax Consequences: In certain situations, such as when an S Corporation has substantial built-in gains, the tax savings achieved through S Corporation Election may be outweighed by the potential tax liability upon conversion.

Eligibility Requirements for Corporation Election

To qualify for Corporation Election, a business must meet the following eligibility requirements as per IRS regulations:

- The business must be a domestic corporation.

- The corporation must have only one class of stock.

- The corporation must have no more than 100 shareholders.

- All shareholders must be individuals, estates, or certain trusts.

- The corporation cannot be a member of an affiliated group of corporations.

- The corporation cannot have more than 25% of its gross income from passive sources, such as dividends, interest, and royalties.

Steps to File Corporation Election

To file Corporation Election, businesses must follow these steps:

- Obtain Form 8832: Acquire Form 8832, Entity Classification Election, from the IRS website or by contacting the IRS directly.

- Complete Form 8832: Carefully complete Form 8832, ensuring all required information is provided accurately and legibly.

- Gather Supporting Documents: Collect any necessary supporting documents, such as the corporation's articles of incorporation, bylaws, and shareholder agreements.

- File Form 8832: Submit Form 8832 to the IRS by mail or fax. The filing deadline is generally the 15th day of the third month following the month in which the corporation was formed.

- Receive Confirmation: The IRS will review the filed Form 8832 and issue a confirmation letter to the corporation, acknowledging the effective date of the S Corporation election.

Expert Insights and Real-World Examples

To provide further clarity and practical guidance, we sought expert insights and gathered real-world examples to illustrate the implications and benefits of Corporation Election:

Expert Insights

"Corporation Election can be a powerful tool for businesses seeking to optimize their tax strategy," said John Smith, a tax attorney with 20 years of experience. "By carefully considering the eligibility requirements and potential implications, businesses can make an informed decision that aligns with their specific goals."

Real-World Example

ABC Corporation, a small business with 10 shareholders, elected S Corporation status. As a result, the corporation avoided double taxation, significantly reducing its overall tax liability. The shareholders were able to pass corporate losses through to their individual tax returns, utilizing them to offset personal income and minimize their tax burden.

Corporation Election is a strategic decision that can have a profound impact on the success and profitability of a business. By understanding the intricacies of Corporation Election, businesses can make informed choices that maximize tax savings, enhance flexibility, and optimize their financial performance. This comprehensive guide has provided a thorough overview of Corporation Election, its implications, eligibility requirements, and the step-by-step filing process. Armed with this knowledge, businesses can confidently navigate the complexities of Corporation Election and unlock its potential for growth and prosperity.

4.7 out of 5

| Language | : | English |

| File size | : | 13832 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 241 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Blanche Barton

Blanche Barton Foundation Of Flexographic Technical...

Foundation Of Flexographic Technical... Paola Roig

Paola Roig Ben Green

Ben Green Nick Summer

Nick Summer Julia Hobsbawm

Julia Hobsbawm Benjamin Franklin

Benjamin Franklin Best Book Briefings

Best Book Briefings Bernard Kamoroff

Bernard Kamoroff Lolo Smith

Lolo Smith Ivy Laika

Ivy Laika Khalid Saleh

Khalid Saleh Bob H Lee

Bob H Lee Leslie Gray Streeter

Leslie Gray Streeter Bob Brier

Bob Brier Bob Dow

Bob Dow Kyle Mitchell

Kyle Mitchell Bill Rumpel

Bill Rumpel Douglas D Scott

Douglas D Scott Bernhard Rieger

Bernhard Rieger

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Brady MitchellEmbark on a Literary Expedition into the Enchanting Embrace of "Northern...

Brady MitchellEmbark on a Literary Expedition into the Enchanting Embrace of "Northern...

Raymond ChandlerText For Instructors And Students: Unveiling the Blueprint for Educational...

Raymond ChandlerText For Instructors And Students: Unveiling the Blueprint for Educational... Raymond ChandlerFollow ·12.4k

Raymond ChandlerFollow ·12.4k Gabriel HayesFollow ·10.1k

Gabriel HayesFollow ·10.1k Robert Louis StevensonFollow ·4.8k

Robert Louis StevensonFollow ·4.8k John GrishamFollow ·9k

John GrishamFollow ·9k Aldous HuxleyFollow ·19.9k

Aldous HuxleyFollow ·19.9k Caleb LongFollow ·8k

Caleb LongFollow ·8k Ernesto SabatoFollow ·17k

Ernesto SabatoFollow ·17k Liam WardFollow ·11.9k

Liam WardFollow ·11.9k

Ivan Cox

Ivan CoxSpeak With Ease: The Ultimate Guide to Public Speaking...

By Rupika Raj ...

Jesus Mitchell

Jesus MitchellVulcan Forge: A Suspense Thriller that Will Keep You on...

Vulcan Forge is...

Dashawn Hayes

Dashawn HayesThe Carteret Family Bob Martin: A Comprehensive Review

Bob Martin's...

Owen Simmons

Owen SimmonsUnlock the World of Cultural Nuances with "The Global...

Embark on a Journey of...

Ian McEwan

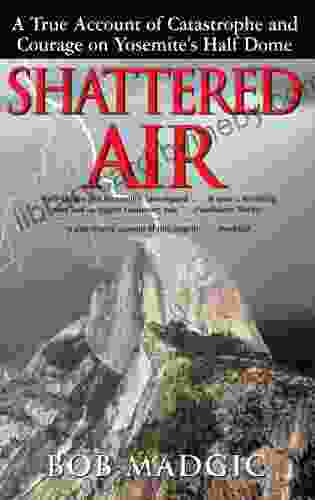

Ian McEwanConquer the Mountain: True Account of Catastrophe and...

In the heart of California's stunning...

4.7 out of 5

| Language | : | English |

| File size | : | 13832 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 241 pages |

| Lending | : | Enabled |